Connecticut Solar Incentives: Save on Energy Costs with Solar Power

Find out how much you can save with the solar incentives and programs in Connecticut.

Start Saving with Solar Power

Instant Savings with Solar

From day one with no delay—solar energy makes an immediate impact on your monthly bills.

Lock in Lower Energy Bills

Lower Your Energy Costs

Say goodbye to rising utility prices and hello to a fixed, lower energy rate for years to come.

Affordable Solar Energy

$0 Upfront Cost of Solar

No surprises—our solar plans are straightforward with no hidden costs, just reliable savings.

Connecticut Homeowners: Maximize Savings with Solar Power and State Incentives

Connecticut is leading the charge in creating a sustainable and eco-friendly future, offering a range of powerful solar energy incentives and rebates. With the state’s commitment to renewable energy, it has never been easier for homeowners to switch to solar power and drastically reduce their energy bills. Connecticut’s solar programs provide exceptional savings opportunities that make solar energy more accessible than ever. By embracing solar power in Connecticut, you not only save on electricity costs but also contribute to a cleaner, greener environment. The state’s generous incentives and rebates make solar a smart financial choice for homeowners, allowing you to lock in predictable energy costs and protect yourself from rising utility prices. If you’re looking to invest in solar energy, Connecticut is the ideal place to do it. Take advantage of the state’s solar programs to reduce your energy bills, increase your home’s value, and take a major step toward a sustainable future. Harness the power of the sun and enjoy long-term savings while supporting the global push for renewable energy.

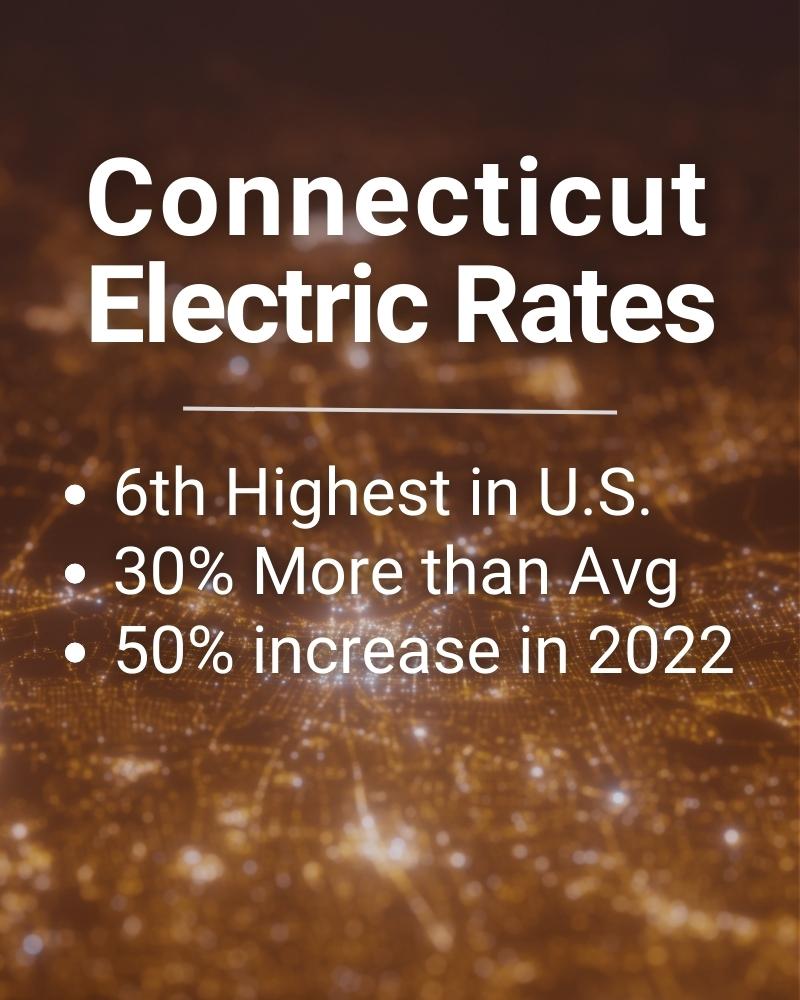

How Connecticut Electric Rates Compare

Connecticut’s electricity rates are rising rapidly, making it one of the top states with the highest energy costs. With residents paying over 30% more than the national average, switching to solar power offers a reliable solution to combat rising utility bills.

Don’t let skyrocketing electricity rates in Connecticut hold you back. Solar power is the key to breaking free from rising utility bills, giving you the control and savings you need to secure your financial future.”

Connecticut Solar Incentives and Rebates

In Connecticut, the sun is shining brighter than ever, bringing substantial savings with it. Thanks to premier solar incentives and state-funded programs, homeowners now have access to affordable solar energy solutions. These programs are designed to make the switch to solar easier and more cost-effective, helping you reduce energy bills while benefiting from clean, renewable energy. Make the most of these incredible opportunities and start saving with solar today!

1.

Save Big with the 30% Federal Solar Tax Credit

Take advantage of a 30% federal solar tax credit to significantly lower the cost of your solar energy system. This incentive applies to the total cost of owning your solar panels, making it a powerful tool for homeowners looking to invest in renewable energy. Plus, if you’re considering leasing solar panels, this credit helps reduce monthly payments, making solar even more accessible.

Keep in mind that to claim the full 30% tax credit, you’ll need sufficient tax liability. Don’t worry if you don’t qualify—we specialize in helping homeowners explore alternative financing options, such as solar leases, power purchase agreements (PPAs), and additional state or local rebates, ensuring you maximize your energy savings.

2.

Increase Your Home Value Without Higher Property Taxes

Installing a solar panel system not only increases your home’s value but also comes with a major financial benefit—property tax exemptions. In most cases, the added value from solar installation will not result in higher property taxes, allowing you to enjoy the benefits of clean energy without the burden of additional costs.

This exemption means you can enhance your property’s worth with renewable energy solutions while keeping your overall expenses low. With solar, you gain value without paying extra—a win for both your wallet and the planet.

3.

No Sales Tax for Solar Panel Systems in Connecticut

Connecticut homeowners enjoy a significant financial advantage when investing in solar energy—solar panel systems are exempt from the state’s 6.35% sales tax. This exemption means you won’t pay any additional sales taxes on your solar installation, reducing upfront costs and making it even more affordable to transition to renewable energy.

By eliminating sales tax, Connecticut helps homeowners save money while investing in a clean energy future. It’s just one more way going solar can maximize your savings and benefits.

4.

Rebates Make Solar Installation More Affordable

Connecticut offers valuable incentives for residents who choose to install solar panel systems on their homes. Through this program, homeowners can access rebates that significantly reduce the upfront cost of going solar, making it more affordable to transition to renewable energy.

These solar rebates not only lower installation expenses but also enhance the overall return on investment, helping homeowners in Connecticut save money while contributing to a sustainable future. Don’t miss out on the opportunity to maximize your savings and make the switch to solar today!

5.

Affordable Solar Solutions with Connecticut’s Green Bank

Connecticut’s Green Bank is making solar energy more accessible for residents through its innovative Solar for All program. Designed to assist low and moderate-income households, this program provides financial support to help cover the cost of solar panel installation. In addition to empowering families with affordable renewable energy, it also fosters local job growth and promotes a cleaner, greener future for communities across the state.

6.

Maximize Savings with Connecticut’s Net Energy Metering Program

Connecticut residents can benefit from utility credits for any excess solar energy their system generates. These credits can offset energy usage at night or on cloudy days, making solar power even more efficient. While many states offer net metering, Connecticut takes it a step further with an additional $0.03 credit for every kilowatt-hour (kWh) overproduced. For a household using the average 10,000 kWh per year, this adds up to a generous $300 annual credit, boosting both your savings and your solar ROI.

7.

Your Solar Earnings with Connecticut’s Buy-All Program

In Connecticut, residential solar customers have the option to sell all the solar power they generate back to the utility company through the Buy-All program. This program offers a fixed rate for your solar power over a 20-year term, which may be higher than your current utility rate. However, it’s important to note that with this option, you won’t be using the solar energy for your own home, and you won’t be able to add a solar battery for backup storage. It’s a great choice for those looking to earn more from their solar production without utilizing the energy directly.

How to Get the CT Solar Energy Incentives

We handle everything from your solar installation to securing federal and state solar incentives – everything except doing your taxes! While we recommend consulting a tax expert, we’re dedicated to helping you maximize your savings. If you don’t qualify for certain incentives, we offer alternative solar solutions like leasing or power purchase agreements (PPAs) to keep you on track for significant solar savings.

While Solar Panels Aren’t Technically ‘Free,’ You Can Save More Than Ever

While you won’t find truly ‘free’ solar panels, switching to solar can feel like getting them for free. In fact, many homeowners pay less for solar energy than they currently do for traditional electricity, and the cost to make the switch is often zero upfront. With available solar incentives and financing options, going solar has never been more affordable.

By switching to solar, you’re replacing an unpredictable, ever-rising electric bill with a fixed, price-protected solar payment that’s typically around 40% lower. While it’s not technically ‘free,’ it’s as close as it gets to eliminating energy costs and securing long-term savings. With solar, you lock in lower rates and enjoy financial stability for years to come.